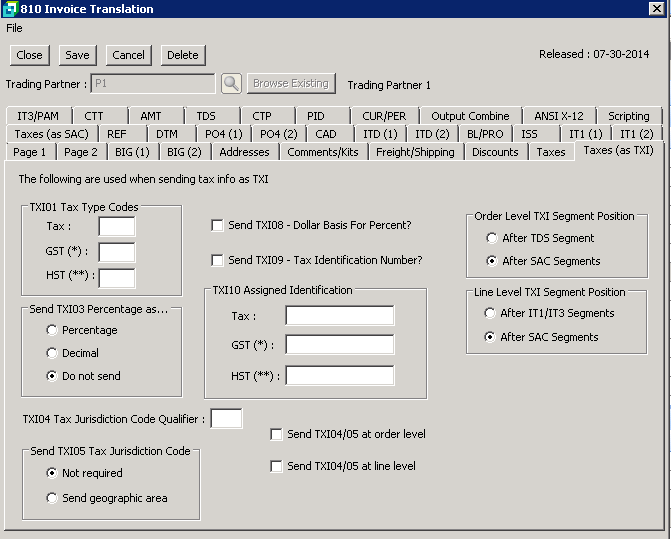

Taxes (as TXI) Tab

The following table outlines the prompts/options available when accessing this screen:

The following are used when sending tax info as TXI

TXI01 Tax Type Codes The TXI01 Tax Type Codes may be left blank. The system will generally choose the correct segment. A code may be entered to override the system choice. |

|

Tax: |

Enter the standard USA tax type code to use when processing orders. |

GST (*): |

Enter GST tax type code if using Canadian type tax. The GST is for all Provinces except as noted under HST tax type. |

HST (**): |

Enter the HST type code if using Canadian type tax. The HST tax is a combination of PST and GST tax and is used for reporting taxes in New Brunswick, Nova Scotia, New Foundland and Labrador Provinces. |

Send TXI03 Percentage as... If the TX013 segment is required, select whether the percentage is to be reported in Percentage or decimal format. |

|

|

|

|

|

|

|

TXI04 Tax Jurisdiction Code Qualifier: |

|

Send TXI05 Tax Jurisdiction Code |

|

|

|

|

|

|

|

|

TXI10 Assigned Identification |

|

Tax: |

|

GST (*): |

|

HST (**): |

|

|

|

|

Order Level TXI Segment Position Certain Trading Partners require the TXI segment to be transmitted in a different position. Select whether to place the TXI segment after the TDS segment or after the SAC segment. The most common setting is after the TDS segment. |

|

|

|

|

|

Line Level TXI Segment Position Certain Trading Partners required the Order Level TXI segment to be transmitted in a different position. Select whether to place the Line Level TXI segment after the IT1/IT3 segment or after the SAC segment. |

|

|

|

|

|